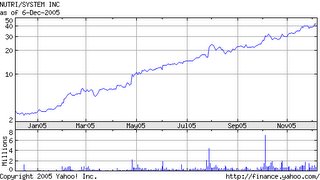

Isn't this beautiful?

$2 becomes $42 in a year. Still counting ... :)

http://mallikreddy.blogspot.com/2005/12/beauty.html

http://biz.yahoo.com/bw/051121/20051121005631.html?.v=1

Even with the time magazine thing, iRobot (IRBT) share price is falling... I looked everywhere and can't figure this out. Any theories?

Even with the time magazine thing, iRobot (IRBT) share price is falling... I looked everywhere and can't figure this out. Any theories?

Google went up by - $13.97 to $372.14 (3.90% increase)

Red Hat went up by - $01.07 to $23.22 (4.83% increase)

I bet you are sorry that you are not holding GOOG but not even thinking anything about RHAT. Why?

Look wide. Look deep. There are better winners. And remember: Past performance is no guarantee for the future.

You buy 1000 shares for $90 each. It rises to $100 a piece. Now you don't want to sell a winner. it might go up to $1000 a piece and you will flog yourselves. You also don't want to sit and watch the share fall back to $85 while you beat your head against the wall thinking "sh*t i should have just sold it...i am a stupid greedy ____".

So you use a "Trailing Stop". When the share hits $100, you put in a trailing stop at 2 points (=$2 -> this can be anything you decide). Now your stop price becomes $98. If the share falls the $98, it will be sold as a market order. BUT, it is goes to $200, your stop moves up with it and becomes $198 and your shares will be sold if the price falls below $198.

To summarize, when you put in a 'Trailing Stop', the "stop" price moves up when the price of the share moves in your favor and stays still when the price of the share moves against you. And once the "stop" price is hit, the share is sold.

Hereby, you allow chances for further gains and also eliminate the risk of losing whatever you gained.

My knowledge on the stock market has been seriously challenged over the past week… and it is proving a costly lesson … anyway, since I am not in a position to give my opinion on effect of inflation and oil prices, . however, based on my assessment, I have something, that may be useful to you …

INFY is has gone down by 10% in the last one week despite best quarterly results, increasing the year end forecast… these results beat the market expectation.. so, why is stocking going down… I have no idea… ????

But I always considered INFY at $70 is good buy and I did make some quick once by buying at 71 and selling at 74.. .anyway, right now, it is trading at 68 or so, and looks like it is going to go down further.. However, it will soon bounce back to $75 or so, keep watching and don’t buy until the stock starts going up.. if you get at below 70, I guess, that is an opportunity to earn some bucks

Why does it bounce back to 75 ? Coz, it traded at this price for about 8 months now and there is no gripping reason why it is going down now..

i have put in a limit order for GOOG at $307. 20th oct = earnings announcement date. i don't want to hold it over that risky period. it is trading for $306 now and if it sells for $307, it will be a profit for around $40 after commissions.

share prices are not dropping like a stone despite inflation fears because of the reduction in the price of crude. the moment another oil price hike news comes in, all stops are going to go and the market will bite the dust (at least for some time). don't despair - buying opportunity.

but don't trade based on my views. u might get burnt. share ur thoughts please...

before u ask - i have done absolutely nothing on the game... please hold on.

Symbol Description Qty Book Val Market Val Tot Val % Chg Gain/Loss

VLO VALERO ENERGY CORP 1 $111.35 $112.48 $112.48 1.01% $1.13

DVN DEVON ENERGY CORP 2 $65.15 $66.73 $133.46 2.43% $3.16

SNDK SANDISK CORP 6 $46.61 $43.79 $262.74 -6.05% -$16.92

CEDC CENTRAL EUROPEAN DIST 3 $43.59 $41.14 $123.42 -5.62% -$7.35

CCRT COMPUCREDIT CORPORATION 3 $42.27 $40.40 $121.20 -4.42% -$5.61

LIFC LIFECELL CORPORATION 5 $24.14 $22.51 $112.55 -6.75% -$8.15

$865.85 -3.23% -$33.74